Ken ITO and Max YATSUZUKA

Facebook released a new “Cryptocurrency” project “Libra” on 18th June and this has stimulated public discussions all over the world.

Following this announcement, G20 summit was held in Japan, along with V20 meeting for the regulation of cryptocurrencies, from 28th to 29th June. Leaders from each government and central bank had gathered in Osaka, and the “framework of free cross-border data flow (with Trust: “OSAKA TRACK”)” was supposedly discussed. However, there is no reference in “Osaka leaders’ declaration” about the “framework of free cross-border financial flow” by Facebook, the Libra project, and only a brief discussion is reported from the V20 forum.

Facebook claims “large swaths of the world's population are still left behind — 1.7 billion adults globally remain outside of the financial system” and Libra would assist them. However, US insists that Facebook’s Libra will “be an alternative to the dollars” and Facebook should “stop the project right now”. Unfortunately, much of early speculations just scratch the surface of this subject and an academic analysis is absent.

Our laboratory has continued fundamental theoretical research on cryptocurrency with Harvard University Kennedy School from 2014. We have pursued, with Prof. Calestous Juma, eradication of poverty by applying “Encrypted Asset” system, i.e. post-block chain technology in African continent, and also extracted major problems on such systems. This article aims to provide our academic insight into Libra.

1 Can Libra be money? : The difference from Bitcoin

Possible global information coverage of Facebook and Libra

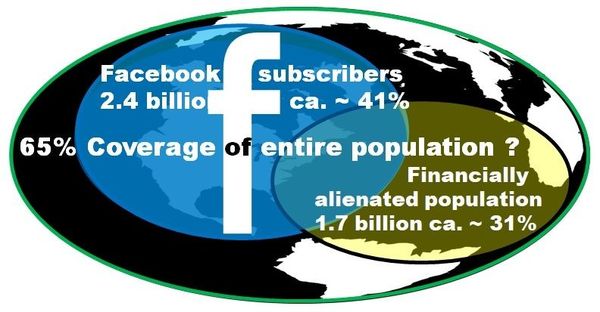

There are 2.4 billion Facebook subscribers, equivalent to 41% of the entire population on this planet. That means Facebook could already “enclose” 40% of the global population with vast amount of personal information network. GAFA— Google, Apple, Facebook and Amazon, are no doubt the champions of the global knowledge-intensive society.

1.7 billion unbanked people, mentioned in the white paper, are equivalent to 31% of the global population. Then, Facebook’s Libra proposal could be regarded as an attempt to enlarge existing “enclosure”, including financial activities of 2.4 +1.7 – overlap (ca. 0.5?) ~ 3.6 billion, i.e. 65% of the global population. Considering the ethics of artificial intelligence and bigdata issues, our first question is “Should a private sector be allowed to possess exclusively a majority of global personal financial information?”

Facebook announced “an independent, not-for-profit membership organization, headquartered in Geneva, Switzerland” would govern Libra. However, US Rep. Maxine Waters immediately declared “We just can’t allow them to go to Switzerland with all of its associates and begin to compete with the dollar.”

Cf. https://www.coindesk.com/rep-maxine-waters-says-us-cant-let-facebooks-libra-compete-with-the-dollar

This opposition aside, we first show the theoretical difference between “Bitcoin” and “Libra”.

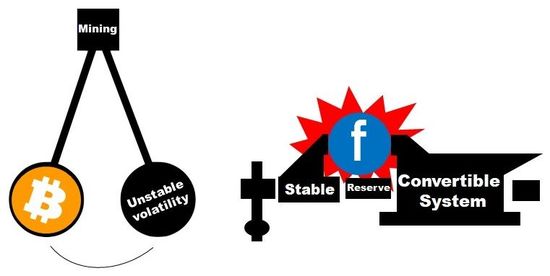

The presence of “mining” is the most apparent difference between Bitcoin and Libra.

In the Bitcoin system, there is harsh mining competition driven by profit motivation. In order to subjugate this competition, a large investment is necessary. The whole business model has been severely criticized due to the serious environmental burden caused by mining. If speculative funds flow into the “COIN market”, the Bitcoin price could easily fluctuate. Its volatility is relatively high and the value of the coin is unstable.

As opposed to Bitcoin, there is no mining competition in the Libra system. Neither heavy environmental burden nor too much volatility. By offering reserve, investors would get stable profit from this new “cryptocurrency” business model. It could be regarded as a kind of “seigniorage”.

Stable Libra, unstable Bitcoin.

In order to understand the fundamental difference between those two above, we would like to go back to the basic theory of money and start discussion from the essential condition for “being currency”. Dr. Prof. Katsuhito IWAI, Japanese authority on Economics and Numismatics, argues the following principle of monetary value;

<Principle of monetary value>;

“For a currency to circulate as money, violent fluctuations of its value (i.e. high volatility) must be evaded and it should not be a product of speculation”.

“Being a currency” means it is exchangeable for (any) goods or services with relative ease. Without this functionality, any coin, banknote or “deposit currency” will not be treated as “money” or facilitator of trade. They can only be treated as some sorts of securities.

For instance, some ancient coins from Roman Empire are traded at premium prices, but they are no longer “currency”. If “the value of the coins as pieces of metal” is higher than “the par value as coinage”, those coins would be treated as “metal” rather than money.

If you buy “COIN A” with $1 today and expect the price would rise to $2 next month, you would rather hold it than spend it. You can sell it next month for $1 gain or keep holding it, hoping for further appreciation of its value.

And if you notice a sharp fall of COIN A’s price, you would sell it to avoid any loss.

In both scenarios, “COIN A” is exchanged with “fiat currencies” but never with “goods or services”. COIN A is an object of speculation and never circulates as “money”, the medium of trade and commerce.

From these analyses above, IWAI immediately deduces “Law of Cryptocurrency”

<Law of Cryptocurrency>;

“Once a cryptocurrency turns into an object of speculation, it can not be exchanged with goods or services as money”. (IWAI, 2013)

From this fundamental examination, it is clear that Bitcoin is no longer currency. People would never buy Coca Cola or are highly unlikely to buy a digital camera with Bitcoin.

How about Facebook’s “Libra”?

Libra has a potential to function as “money”.

Facebook claims as follows;

“Libra is designed to be a stable digital cryptocurrency that will be fully backed by a reserve of real assets — the Libra Reserve — and supported by a competitive network of exchanges buying and selling Libra. That means anyone with Libra has a high degree of assurance they can convert their digital currency into local fiat currency based on an exchange rate, just like exchanging one currency for another when traveling.” (from the “whitepaper”).

Libra is totally different from Bitcoin. To avoid risks of turning into speculation objects, Facebook will prepare “Reserve” which backs the value of this new “cryptocurrency” and stabilizes the price in order to ensure its functionality as “money”.

Libra network assures “high probability” to “convert their digital currency into local fiat currency based on an exchange rate” so that there is a minimal risk of speculative investment and violent fluctuation.

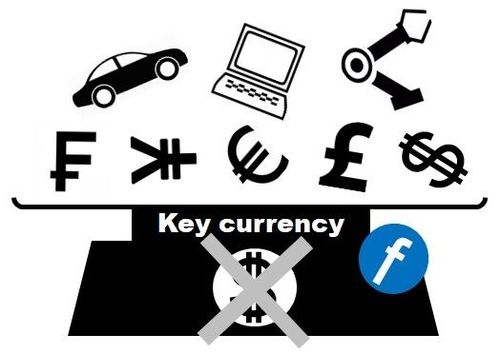

In other words, Libra may potentially be a “key currency”. This will be discussed in the latter part.

On one hand, this change is revolutionary. Any conventional “cryptocurrency” couldn’t play this role. When we had worked on “encrypted asset for the eradication of poverty in Africa” with Kennedy School, Harvard University, almost nobody in Boston had paid attention to our project. They did not come up with any short-term profit-making model.

If any digital currency system like Libra adequately circulate around the globe and connect 1.7 billion financially alienated people to the network society, there would NOT only be ASSET economy profit BUT also substantial REAL economic growth. This is impossible for any other existing cryptocurrencies. Such possibility is, no doubt, a positive aspect of the “Libra” project.

However, on the other hand, we have to point out the fundamental risk of Libra as a “convertible currency”.

It is a kind of regression to the standard monetary system. Financial system based on convertible currency, such as the Gold Standard, has an apparent risk of classical bankruptcy.

We should now examine this kind of old-and-new risk on this Facebook’s new cryptocurrency.

2 J. M. Keynes’ admonition; Fundamental Vulnerability of Convertible Currency

The Gold Standard system was introduced to United Kingdom in the beginning of 19th century, just after the Napoleonic Wars. It played crucial role in the development of global capitalism. Under this system, money supply is regulated by GOLD RESERVE. In the latter half of 19th century, especially after the Crimean War (1853-56), lack of gold caused the first global financial crisis in the human history.

The notorious Great Depression occurred in 1929. Fundamentally speaking, the Depression was caused in part by gold shortage (Quite similarly, the 2008 global financial crisis was partly caused by the dollar shortage).

John Maynard Keynes’ thought was greatly utilized for the social and economic rearrangement after this depression.

One representative example is the New Deal program of US government, led by Franklin Roosevelt, the Democrat. Soon after, the Second World War broke out. At the end of the war, well-known Bretton Woods conference (1944) was held for the re-establishment of international monetary order.

Keynes was totally against the Gold Standard system and proposed his plan for the managed currency system based on the idea of young Ernst Schumacher. Despite his effort, the conference adopted the US plan proposed by Harry White, an assistant to the US Secretary of Treasury Henry Morgenthau. The IMF system, which partially maintained the Gold Standard, was accepted.

Allied countries deposited both their own currencies and gold bullions to the IMF RESERVE in order to achieve global financial stabilization. It facilitated the post-war rapid economic growth, up to the end of 1960’s. But the stagnant IMF system eventually failed to support global finance. After all, the standard monetary system had an intrinsic risk of stagnancy, as previously claimed by Keynes.

Richard Nixon finally abolished conversion of gold and the dollar in 1971 and the contemporary managed currency system had begun to work.

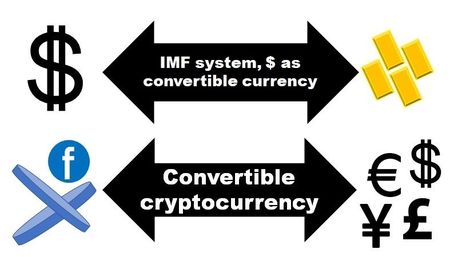

Now, Facebook’s Libra is proposed as a sort of “convertible (crypto-)currency”. The convertible system is effective to stabilize the price of Libra. Simultaneously, Libra also has to take all possible risks of standard monetary system.

Once credit insecurity spread over the convertible financial system, even classical bank run could occur. All possible regulation to the standard system has to be applied for this new “crypto-convertible currency”. This system is reported to be illegal by Indian law.

In fact, Libra is similar to the US dollars in the IMF system, which played the role of convertible banknote with bullion. Remember, the post-war economic growth was hampered by this “convertible key currency” in this system.

“Convertible cryptocurrency”

3 Why does US fear Libra ?

Facebook claimed many advantages of “Libra” in the “whitepaper” https://libra.org/en-US/white-paper/, such as “scalable, reliable blockchain”, “independence” and “non-profit”. It also emphasizes sharp distinction between Facebook and Libra in order to secure consumers’ personal information. However, US Rep. Maxine Waters, as mentioned above, immediately requested to stop the development of “Libra” project. She pointed out problems, such as “protection of consumers”, “money laundering” and “privacy invasion”.

We believe that keyword here is “key currency”, the US dollar.

In the Bretton Woods conference (1944), J. M. Keynes was completely against the Gold Standard system and claimed that the system hampers money supply and could be one of the causes of financial crisis. But the Gold Standard was partially kept and the dollar was adopted as “key currency” at the end.

Even after the “Nixon shock” in 1971, the dollar has kept its unique position in the global financial system.

Though managed currency system had been adopted and maintained relatively well, lack of the dollar caused the global financial crisis in 2008. Soon after, Bitcoin and Blockchain system were proposed. It severely criticized the existing financial network system.

A practical peer-to-peer digital currency system without center of trust was proposed for the first time, and privileges of central banks are completely denied there.

After the announcement of Libra, opposition, or total denial to “the new cryptocurrency” was almost instant reaction of the United States. Why does US fear Libra so much?

The most fundamental reason is that Libra can replace the dollar as global key currency. Present Republican US government mostly has pursued protective policies. Those policies aren’t beneficial to the dollar as global key currency.

It is interesting to find that most of the founding companies in the Libra Association are US affiliated corporations. Criticism occurs within the States.

Bitcoin, the first cryptocurrency was proposed under the name of “Satoshi NAKAMOTO”. It harshly criticizes the financial system, denied the seigniorage of central banks, and embodied settlement system without center of trust. Bitcoin may be from US as well.

In fact, there was no “central bank” in United States before the beginning of 20th century. The central bank system of America is named “Federal Reserve System” but there is no regulation for the money supply with “RESERVE” and the seigniorage under the managed currency system. NAKAMOTO sharply criticized this monopoly and designed ideally distributed P2P settlement system,

Issues around Libra raises fundamental arguments on finance, economy and the whole society. They also contain basic merit and demerit, security and risk. In any case, Facebook and Libra are required to take the greatest responsibility for Artificial Intelligence Ethics in the knowledge intensive global society.

We had also prepared theoretical and mathematical framework of “free cross border financial flow (with Trust)”. They should be discussed in the following articles.

Global key currency replacement ?

A few have already published substantial academic text book on the fundamental basis of cryptocurrency / encrypted asset. The authors are now preparing “Encrypted Asset and 21st century Capitalism” (University of Tokyo Press), hoping to contribute to its necessities.

(20th June 2019 – 30th June 2019 revised.)

Ken ITO, Dr. Prof. Interfaculty Initiative in Information Sciences,

The University of Tokyo

Max YATSUZUKA, Visiting researcher of The University of Tokyo,

Associate Member of CPA Australia

Special thanks to Lang WILLETT, Vyapuri NAMASIVAYAM and Michelle YATSUZUKA