Zero emissions' return on investment is minus 94%

In its New Year's edition, The Nikkei newspaper stated, "with the world competing for a leading role in decarbonization, ¥8,500 trillion in Japan, US, Europe, and China." Investment companies around the world use such ESG investments as sales talk.

Since this is sweet talk about environmental, social, and corporate governance, no one would oppose it. The question is, would it increase profits? For example, if a power company discontinues coal-fired power and switches to solar power, the duplicate investment in a backup power plant doubles the cost and the profit return is zero.

The benefit of decarbonization is the temperature for the public. Therefore, there is no point in private companies investing in it. If the government subsidizes carbon-free investments, it will be profitable. However, it only burdens the taxpayers. ESG investments are a charity funded by shareholders' money.

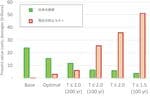

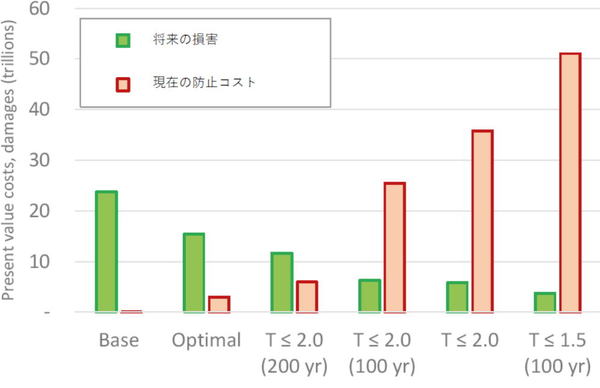

However, it is possible that the return will be positive for mankind as a whole. Fig. 3 is what William Nordhaus showed in his lecture in 2018 when he won the Nobel Memorial Prize in Economic Sciences. It is similar to the long-term goal of the Paris Agreement to suppress the temperature increase in 100 years by 1.5℃ (T ≤ 1.5) since the Industrial Revolution.

Fig. 3 Cost-effectiveness of global warming prevention (Nordhaus).

Fig. 3 Cost-effectiveness of global warming prevention (Nordhaus).

Assuming that this will be achieved with zero emissions, the cost would be about US$50 trillion worldwide. However, the resulting profits (preventing loss from global warming) is about US$3 trillion. In other words, the rate of return on zero emissions is minus 94 percent.

This high cost is due to the rushed use of inefficient decarbonization technologies. Although it is sensible to reduce CO2, it does not make sense to set 2050 as the deadline. Since advances in technologies will develop energy-saving decarbonization technologies, they should be used for cost-effective investments.

Nordhaus says that the optimal level at which the investment return (current value of future losses) and current prevention costs become equal will be when the temperature increase is limited to around 3℃ by 2100. Since this is a rise of 2℃ henceforth and when we consider recent trends (around RCP4.5), the optimal level can be attained even without taking hurried measures against global warming.

The only highly profitable decarbonization investment is nuclear power. Even the Green Growth Strategy is investing in next-generation nuclear technologies such as small modular reactors (SMRs). However, they must first restart the offline nuclear power plants and extend their service life from 40 years to 60 years. Unless this troublesome problem is resolved, the Green Growth Strategy will just be a pie in the sky no matter what idealistic things they say.